- Start With Sam

- Posts

- The Best Passive Income Investments If You Have $2,000 to $10,000

The Best Passive Income Investments If You Have $2,000 to $10,000

Hello,

One of the most common questions I get from friends, followers, Reddit or Facebook communities is:

"What should I invest in if I have X amount of money?"

With a mid-range budget of $2,000 to $10,000, many people wonder about the smartest way to grow their money.

To be honest, there are plenty of options available.

But if you're looking to set up one of the easiest sources of passive income, here’s my go-to answer:

One of the best sources of passive income you can build, especially if you're starting with a small amount, is the stock market.

Disclaimer: This post contains affiliate links. If you sign up or make a purchase through these links, I may earn a commission at no extra cost to you. This helps support my work and allows me to keep sharing free content with you.

Why the Stock Market?

Because it's one of the few places where your money can grow without you having to worry about it or hustle extra hours, if you do it correctly.

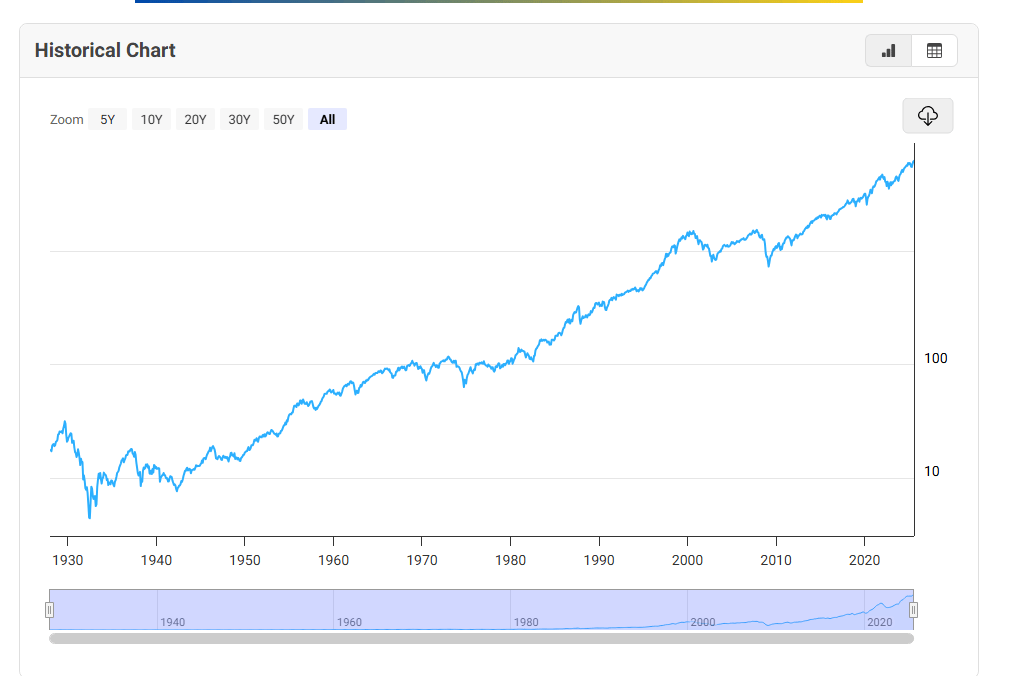

Historically, the stock market has returned around 7 to 10% annually when you zoom out over the long term.

For example, if you invest $10,000 in the S&P 500 and it grows at an average annual return of 8%, after 30 years, that $10,000 could grow to about $100,626, without any extra effort on your part (thanks to compound interest).

It sounds so good, right?

But First, Know This: Trading vs. Investing

Let me be clear: I'm not a professional trader, and I wouldn't recommend day trading or trying to time the market unless you really know what you're doing.

This post is all about investing, not quick flips, not meme stocks, not risky plays.

Investing means putting your money into assets you believe will grow over time and letting compound interest do the heavy lifting.

It's a long game, but it's powerful.

Where Should Beginners Start?

If you're new to the game, I recommend sticking with diversified, low-cost ETFs (Exchange-Traded Funds). Here are a few solid options that you could select to invest:

S&P 500 (e.g., SPY or VOO): This tracks 500 of the biggest companies in the U.S., Apple, Amazon, Google, etc. It's like betting on the U.S. economy as a whole.

VTI (Total U.S. Market): Even more diversified than the S&P 500. It includes large, mid, and small-cap stocks across the entire U.S. stock market.

Dividend ETFs (e.g., SCHD): These pay you cash (dividends) regularly just for holding them. Great for generating passive income.

REITs (e.g., VNQ): Real Estate Investment Trusts let you invest in real estate without actually buying property. They also often pay attractive dividends.

These funds are popular for a reason: they’re diversified, historically stable, and perfect for long-term investors.

Most importantly, they tend to go up in value over time because they are made up of high-quality companies and real estate assets that grow with the economy.

While there are short-term dips, the overall trend over the decades has been upward.

For example, the S&P 500 has grown from under 1,000 points in the 1980s to over 5,000 points today, despite multiple recessions and market crashes along the way.

Similarly, VTI has nearly tripled in value over the past 10 years, reflecting the consistent long-term growth of the broader U.S. economy.

By investing in these types of funds, you're effectively riding the long-term growth of the economy without needing to pick individual stocks or time the market.

This is a very passive and safe way to help you build a solid source of income.

You can simply buy them and do nothing, your money will grow over time. That’s the definition of true passive income.

What Is the Best Investing App for Beginners?

When it comes to investing, a lot of beginners don't know what to choose since there are so many different options. I personally would suggest Robinhood.

I have been using Robinhood for the past 6 years, and I think it is a great app. It gives me all the tools I need to invest confidently and easily.

The tools are helpful and easy to use, designed in a way that even beginners can navigate without feeling overwhelmed.

They're not too advanced or confusing, which makes the whole experience more approachable. It also helps me with tax reports, which is a big plus.

I love that I can check my portfolio on the go, set up recurring investments, and learn as I go. If you're just 👉getting started with Robinhood, it's a great place to dip your toes into the market.

Final Thoughts

I truly believe everyone should invest in the stock market, even if you're starting small.

If you already have a bit of capital, like $2,000 to $10,000,this is one of the most passive and low-effort ways to build a solid source of income over time.

The earlier you start, the more time your money has to grow.

You don’t need to be a finance expert. You don’t need to have $100K.

You just need to start. Your future self will thank you for it.

Thanks for reading.